How Do I Register A Business Name In Florida

Starting an LLC in Florida is Like shooting fish in a barrel

To kickoff a Florida LLC, you'll need to file the Articles of Arrangement with the Florida Partition of Corporations. The filing fee is $125. This tin be washed online at the SunBiz website or past mail. The Articles of System is the document that officially creates your Florida limited liability company.

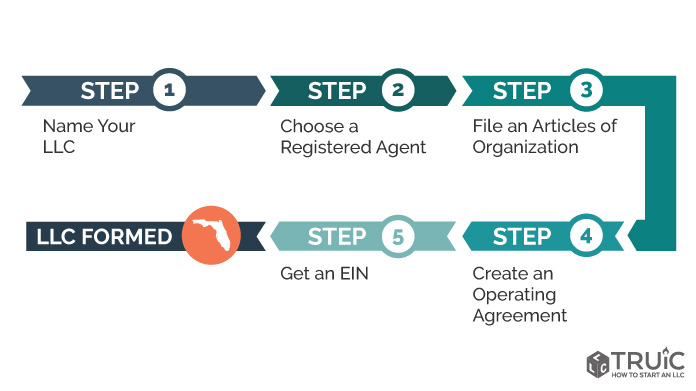

Follow our step-by-pace How to Start an LLC in Florida guide to get started today. You can learn more than about LLCs and their benefits in our What is an LLC guide.

STEP 1: Name Your Florida LLC

Choosing a company name is the outset and virtually of import step in forming an LLC in Florida. Be sure to choose a name that complies with Florida naming laws, requirements, and is easily searchable by potential business clients.

1. Follow the naming guidelines for a Florida LLC:

- Your name must include the phrase "limited liability company," or ane of its abbreviations (LLC or L.L.C.).

- Your proper noun cannot include words that could misfile your LLC with a government bureau (FBI, Treasury, State Department, etc.).

- Restricted words (eastward.g. Bank, Attorney, University) may crave additional paperwork and a licensed individual, such every bit a doctor or lawyer, to exist part of your Florida LLC.

2. Is the name available in Florida? Make sure the name you want isn't already taken past doing a name search on the Sunbiz Florida website.

To learn more nigh searching for a Florida LLC proper name, read our full guide.

iii. Is the URL available? We recommend that y'all check online to come across if your business concern name is available as a web domain. Even if you don't plan to create a business website today, yous may want to buy the URL in society to forestall others from acquiring it.

Afterward securing a domain proper noun for your LLC, consider setting upward a business phone service to establish further credibility and improve customer satisfaction. Nextiva offers a variety of helpful features such as unlimited voice and video callings, a convenient mobile app, and more than. Effort Nextiva today.

Not certain what to name your business concern? Check out our LLC Name Generator. Subsequently you lot become your business proper name, your next step is getting a unique logo. Get your unique logo using our Free Logo Generator.

FAQ: Naming a Florida LLC

What is an LLC?

LLC is short for Express Liability Company. It is a elementary business structure that offers more flexibility than a traditional corporation while providing many of the same benefits. Read "What is a Limited Liability Company?" for more data.

Lookout our video: What is an LLC?

Exercise I demand to get a DBA or Merchandise Name for my business?

Most LLCs exercise not need a DBA. The proper noun of the LLC can serve equally your company's brand proper noun and you can accept checks and other payments under that name besides. However, you may wish to annals a DBA if you would like to conduct business under another name.

To Learn more than virtually DBAs in your state, read our How to File a DBA in Florida guide.

STEP 2: Cull a Registered Agent in Florida

You are required to appoint a Florida Registered Agent for your Florida LLC.

What is a Registered Agent? A registered amanuensis is an individual or business concern entity responsible for receiving important tax forms, legal documents, notice of lawsuits, and official government correspondence on behalf of your business concern. Think of your registered agent every bit your business' point of contact with the state.

Who can be a Registered Agent? A registered agent must be a full-fourth dimension resident of Florida or a corporation, such as a registered amanuensis service, authorized to carry business in the state of Florida. You may elect an individual inside the company including yourself.

To acquire more most Florida Registered Agents, read our total guide.

Recommended: ZenBusiness provides the first twelvemonth of registered amanuensis service complimentary with LLC formation ($39 + State Fees)

FAQ: Nominating a Registered Agent

Can I exist my own Registered Amanuensis?

Aye. You or anyone else in your company tin serve as the registered agent for your LLC. Read nigh being your ain registered agent.

Is a Registered Agent service worth it?

Using a professional Registered Agent service is an affordable way to manage government filings for your LLC. For most businesses, the advantages (e.chiliad. privacy, peace of listen, and preventing lawsuits) of using a professional registered agent service significantly outweigh the almanac costs.

For more than data, read our commodity on Florida registered agents.

STEP 3: File Your Florida LLC Articles of Organisation

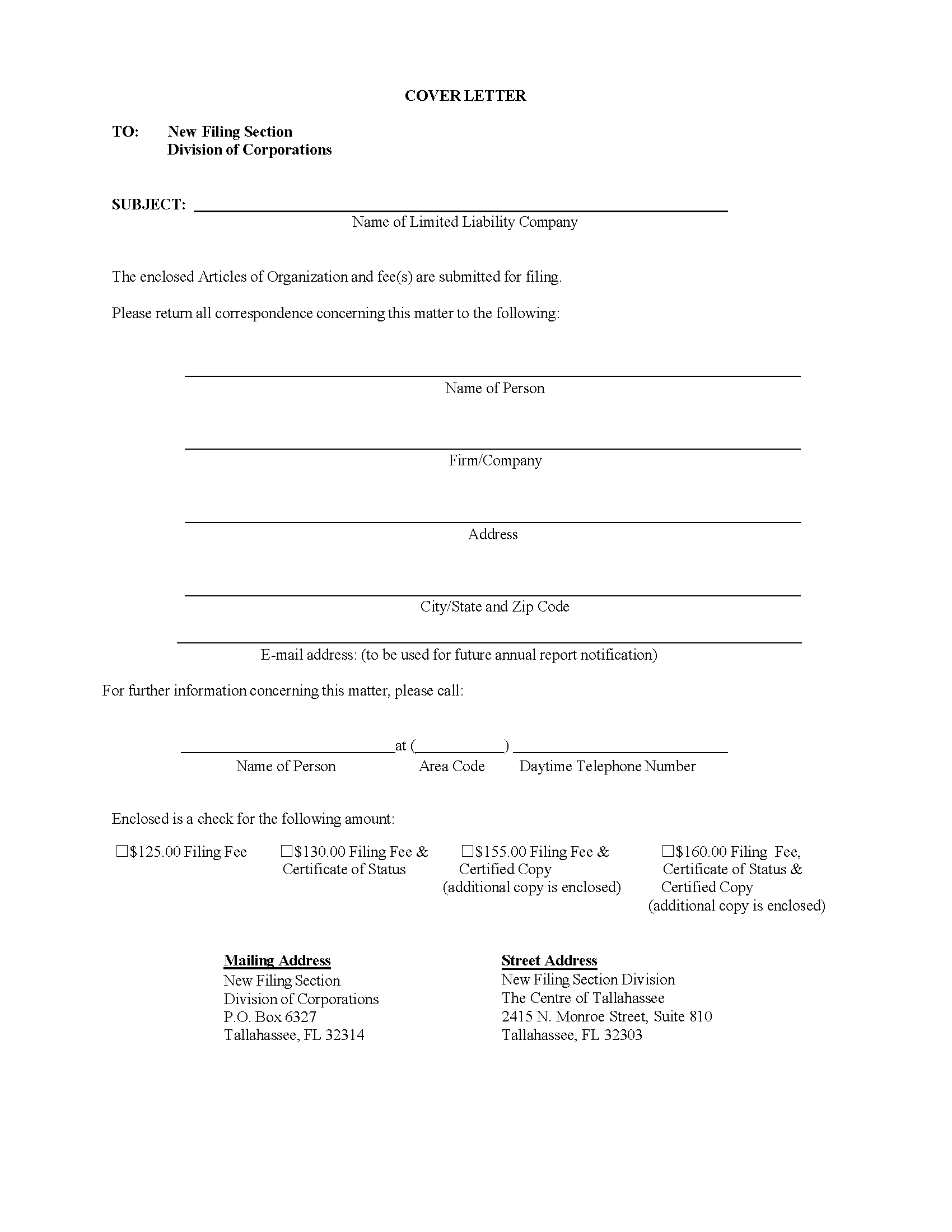

To register your Florida LLC, yous'll need to file Course LLC-1 - Articles of Organization with the Florida Sectionalisation of Corporations. You can apply online or by mail.

Now is a good time to determine whether your LLC will exist member-managed vs. manager-managed.

FILE THE ARTICLES OF ORGANIZATION

Pick one: File Online through the Florida Department of State Sunbiz Website

File Online

- OR -

Selection 2: File by Mail

Download Form

State Filing Cost: $125, payable to the Florida Section of State. (Nonrefundable)

Mail service to:

New Filing Section

Partition of Corporations

P.O. Box 6327

Tallahassee, FL 32314

For aid with completing the form, visit our Florida Articles of Arrangement guide.

If you're expanding your existing LLC to the country of Florida, you lot'll need to register as a Foreign LLC.

FAQ: Filing Florida LLC Documents

How long does information technology take to course an LLC in Florida?

Florida LLC Articles of Organization are processed in the order they are recieved, and can take up from 2 to four weeks.

What is the difference betwixt a domestic Florida LLC and foreign LLC?

An LLC is referred to as a "domestic LLC" when it conducts business in the state where information technology was formed. Normally when we refer to an LLC we are actually referring to a domestic LLC. A foreign LLC must exist formed when an existing LLC wishes to expand its business to another state. If you are filing as a foreign Florida LLC read our guide for more information.

STEP four: Create a Florida LLC Operating Agreement

An operating agreement is not required for an LLC in Florida, but it's a good practice to have i.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements of import? A comprehensive operating agreement ensures that all business concern owners are on the aforementioned page and reduces the run a risk of future conflict.

For more data on operating agreements, read our Florida LLC operating agreement guide.

FAQ: Creating a Florida LLC Operating Understanding

Practice I demand to file my operating understanding with the Country of Florida?

No. The operating understanding is an internal certificate that you should go along on file for future reference.

STEP 5: Get an EIN for your Florida LLC

What is an EIN? The Employer Identification Number (EIN), Federal Employer Identification Number (FEIN), or Federal Tax Identification Number (FTIN), is a 9-digit number issued past the Internal Revenue Organisation (IRS); an Employer ID Number is used to identify a business entity and keep runway of a business organisation'southward tax reporting. It is essentially a social security number (SSN) for the company.. It is essentially a Social Security number for the company.

Why practice I need an EIN? An EIN number is required for the following:

- To open a business concern business organization banking company account for the company

- For Federal and State tax purposes

- To hire employees for the company

Where practice I get an EIN? An EIN is obtained from the IRS (free of charge) by the concern possessor afterward forming the company. This can exist done online or by mail.

FOR INTERNATIONAL APPLICANTS: You lot do not need an SSN to obtain an EIN. Read our guide to getting an EIN for international entrepreneurs.

Get an EIN

Option 1: Request an EIN from the IRS

Utilize Online

- OR -

Selection two: Apply for an EIN by Postal service or Fax

Download Form

Mail to:

Internal Acquirement Service

Attn: EIN Performance

Cincinnati, OH 45999

Fax:

(855) 641-6935

Fee: Gratis

FAQ: Getting an EIN

How exercise I go an EIN if I don't have a Social Security number?

An SSN is non required to go an EIN. Y'all can simply fill out IRS Form SS-4 and leave department 7b blank. And then call the IRS at 267-941-1099 to complete your application. Read our guide for international EIN applicants.

What tax structure should I choose for my LLC?

When you lot become an EIN, you will be informed of the different tax nomenclature options that are bachelor. Almost LLCs elect the default tax status.

However, some LLCs tin reduce their federal revenue enhancement obligation by choosing S corporation condition. Nosotros recommend consulting with a local accountant to notice out which choice is best for you.

Practice I demand an EIN for my LLC?

All LLCs with employees, or any LLC with more than than one member, must have an EIN. This is required by the IRS.

Learn why we recommend e'er getting an EIN and how to get one for gratis in our Do I Need an EIN for an LLC guide.

Have a question? Exit a Comment!

Ask usa a question, tell us how we're doing, or share your experiences. Bring together the conversation in our Annotate Section.

Have a question? Leave a Comment!

Enquire us a question, tell usa how we're doing, or share your experiences. Join the conversation in our Annotate Section.

Because Using an LLC Formation Service?

We reviewed and ranked the tiptop v LLC formation services. Observe out which is best for you.

Best LLC Services

Important Steps After Forming an LLC

Separate Your Personal & Business Assets

When your personal and business organisation accounts are mixed, your personal avails (your home, car, and other valuables) are at take a chance in the event your Florida LLC is sued. In concern constabulary, this is referred to as piercing the corporate veil.

You lot can offset protecting your LLC in Florida with these steps:

1. Opening a business banking concern account:

- Separates your personal assets from your company'south assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Need help finding your EIN for your bank application? Visit our EIN Lookup guide for help.

Recommended: Read our Best Banks for Small Business review to observe the best national bank, credit spousal relationship, business-loan friendly banks, one with many brick-and-mortar locations, and more than.

2. Getting a business organization credit card:

- Helps categorize and dissever all business expenses for end-of-year tax purposes.

- Helps build your business credit score — an essential step toward getting a line of credit or business loans in the hereafter.

- Allows you lot to keep rail of department expenses past issuing multiple cards (with multiple budgets) to your employees.

For a closer look at concern credit cards and their benefits, check out our review of the best small concern credit cards.

Recommended: Visit Divvy to apply for their business concern credit card and build your business credit quickly.

Apply With Divvy

For other of import steps to protect your corporate veil, like properly signing legal documents and documenting visitor business, please read our corporate veil article.

3. Hiring a business organisation auditor:

- Prevents your business from overpaying on taxes while helping you avoid penalties, fines, and other costly tax errors.

- Makes bookkeeping and payroll easier, leaving you with more time to focus on your growing business.

- Manages your business funding more than effectively, discovering areas of unforeseen loss or extra profit

For more business organisation accounting tools, read our guide to the best business accounting software.

Get Business concern Insurance for Your LLC

Business insurance helps you manage risks and focus on growing your Florida LLC. The most common types of business insurance are:

- General Liability Insurance: A wide insurance policy that protects your business organisation from lawsuits. Most pocket-size businesses get general liability insurance.

- Professional Liability Insurance: A business insurance for professional service providers (consultants, accountants, etc.) that covers claims of malpractice and other business errors.

- Workers' Compensation Insurance: A type of insurance that provides coverage for employees' job-related illnesses, injuries, or deaths.

Read our review of the best small business insurance companies.

Create Your Website

Creating a website is a big stride in legitimizing your business. Every business needs a website. Even if you think that your concern is too small or in an offline industry, if you don't accept a website, you lot are missing out on a large percentage of potential customers and acquirement.

Some may fear that creating a business website is out of their attain because they don't have whatever website-building feel. While this may take been a reasonable fear back in 2015, web technology has seen huge advancements in the by few years that makes the lives of small business owners much simpler.

Here are the primary reasons why you shouldn't delay building your website:

- All legitimate businesses take websites - full end. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own and command.

- Website architect tools like the GoDaddy Website Architect have fabricated creating a basic website extremely elementary. Yous don't demand to hire a spider web developer or designer to create a website that you can be proud of.

Using our website edifice guides, the process will be simple and painless and shouldn't take you whatsoever longer than 2-3 hours to complete.

Ship Out a Press Release

Press releases are amongst the easiest and all-time ways to promote your business. They are also one of the most cost-effective strategies as they:

- Provides publicity

- Establish your brand presence on the web

- Improve your website'south search engine optimization (SEO), driving more customers to your website

- Are a 1-time toll in terms of attempt and money

- Take long-lasting benefits

Keep Your Visitor Compliant

Florida Business organization Permits & Licenses

Practice I demand concern licenses and permits?

To operate your LLC y'all must comply with federal, land, and local government regulations. For example, restaurants likely need health permits, edifice permits, signage permits, etc.

The details of business organisation licenses and permits vary from state to state. Make certain you read carefully. Don't be surprised if there are short classes required too.

Fees for business licenses and permits will vary depending on what sort of license you are seeking to obtain.

Find out how to obtain necessary Florida business licenses and permits for your LLC or accept a professional service do information technology for you:

- Business License Guide: Use our detailed Florida Business organization License guide.

- Federal: Utilize the U.Due south. Pocket-sized Business Administration (SBA) guide to federal business licenses and permits.

- State: Check out the SBA'due south Florida Business Resources page to research which permits you volition need for your LLC.

- Local: Contact your local county clerk and ask virtually local licenses and permits.

Recommended: If you are a beginning-fourth dimension entrepreneur, consider having a professional service research your business's licensing requirements. Read our best business organization license services review on Startup Savant.

Florida LLC Taxation Filing Requirements

Depending on the nature of your business organisation, you lot may be required to register for 1 or more than forms of state tax:

Sales Tax

If yous are selling a physical product, y'all'll typically need to register for a seller's permit through the Florida Department of Revenue website.

This certificate allows a business to collect sales revenue enhancement on taxable sales.

Sales tax, also chosen "Sales and Use Tax," is a tax levied by states, counties, and municipalities on business organisation transactions involving the commutation of sure taxable goods or services.

Read our Florida sales tax guide to find out more.

Employer Taxes

If you lot take employees in Florida, yous will need to register for Florida Re-employment Tax, a type of unemployment tax, through the Florida Section of Acquirement. New employers pay an initial tax rate of .0270 (ii.7%) on the first $7,000 of yearly wages paid to employees.

Industry Specific Taxes

If your business concern falls within a specific industry, boosted state taxes may apply.

Federal LLC Tax Filing Requirements

Well-nigh LLCs will need to written report their income to the IRS each year using:

- Form 1065 Partnership Return (nearly multi-member LLCs apply this form)

- Form 1040 Schedule C (well-nigh single-fellow member LLCs use this form)

How you pay yourself as an possessor will also bear upon your federal taxes. Visit our guide to learn more almost how to pay yourself from your LLC.

Read our LLC Revenue enhancement Guide to learn more virtually federal income taxes for LLCs.

Florida LLC Annual Report

LLCs in Florida are required to file an almanac report with the Florida Department of State. This can exist done online.

File Online through Sunbiz Florida for your LLC

Apply Online

Fee: $138.75 (Nonrefundable)

Due Date: Florida's deadline for filing the annual study is May 1st of each twelvemonth. Your LLCs first annual study is due the adjacent calendar year after your llc was formed, and then for an llc formed in 2019, its first annual report can be filed anytime between January 1st 2020 and May 1st 2020, and so before May 1st each subsequent yr.

Late Filings: Florida charges a $400 penalty if you lot miss the May 1st filing deadline. In addition, failure to file your annual report by the third week of September will cause your LLC to be dissolved.

Hiring Employees

If you plan to hire employees, stay compliant with the constabulary by post-obit these steps:

- Verify that new employees are able to piece of work in the US

- Written report employees every bit "new hires" to the Land

- Provide workers' compensation insurance for employees

- Withhold employee taxes

- Print compliance posters and place them in visible areas of your work space

FAQ: Hiring Employees

What is the minimum wage in Florida?

The minimum wage in Florida is $10 per hr

How often do I need to pay employees?

Florida has no specified regulations on pay frequency. However Federal police force states that you must have a consistent pay frequency. Typically virtually employers pay on a semi-monthly basis.

Avoid Automated Dissolution

LLCs may face fines and even automated dissolution when they miss one or more state filings. When this happens, LLC owners risk loss of limited liability protection. A quality registered agent service tin can help forestall this effect past notifying yous of upcoming filing deadlines, and even submitting reports on your behalf for an boosted fee.

Recommended: ZenBusiness offers a reliable registered agent service and excellent client support. Learn more by reading our ZenBusiness Review.

Modest Business Resources

Get Aid Starting a Business in Florida

We understand that creating an LLC in Florida and getting your business concern up and running comes with many challenges. To help you succeed, we compiled the best local resource in every major metro area in Florida. Y'all can get free help in the following areas:

Jacksonville | Miami | Orlando | Tallahassee | Tampa

Small Business Trends

Learn about the current U.s.a. business trends so you can brand the nearly informed business decisions.

Women in Business Tools and Resources

If you have a woman-owned business, many resources are available to help y'all concentrate on your business's growth:

- Funding - (ie. grants, investors, loans)

- Events - (ie. conferences, meetups)

- Guides - (ie. business germination, personal growth)

- Support - (ie. advice, communities, business strategies)

Our data and tools volition provide educational sources, allow you to connect with other women entrepreneurs, and aid you manage your business with ease.

Free LLC Legal Forms

TRUiC offers a number of free LLC legal forms to assistance with creating documents like:

- Operating agreements

- LLC resolutions

- Hiring documents, including:

- Employment contracts

- Contained contractor service agreements (ICSA)

- Not-disclosure agreements (NDA)

All y'all'll need to do to download the forms is sign upward for the TRUiC Business Center, which is also free, forever.

How to Build Business organisation Credit

Learning how to build business credit can help you get credit cards and other business concern funding options in your concern'south name (instead of yours), with better involvement rates, higher lines of credit, and more.

TRUiC's Pocket-size Business Tools

TRUiC believes business organization tools should exist free and useful. Our tools help solve business challenges, from finding an idea for your business organisation, to creating a business organization program, writing an operating understanding for your LLC, and more.

Bank check out TRUiC's small business organization tools:

- Concern Name Generator

- Business Idea Generator

- Gratis Logo Maker

- Operating Understanding Tool

- Business organisation Plan Generator

- Entrepreneur Quiz

More Florida LLC Data

Florida Foreign LLCs

Forming a foreign LLC allows your company to operate every bit one entity in multiple states. If you lot accept an existing LLC and desire to do business in Florida, you volition need to register as a strange LLC. This tin be done past postal service.

REGISTER Equally A FOREIGN LLC IN FLORIDA

File a Foreign LLC past Mail

Download Form

Fee: $125 (Nonrefundable)

Mail to:

Division of Corporations

Registration Section

P.O. Box 6327

Tallahassee, FL 32314

How to Obtain Certificate of Proficient Standing in Florida

A Document of Skilful Standing, known in Florida equally a Document of Status, verifies that your Florida LLC was legally formed and has been properly maintained. Several instances where yous might need to go one include:

- Seeking funding from banks or other lenders

- Forming your business concern every bit a strange LLC in some other state

- Obtaining or renewing specific business licenses or permits

Yous can order a Certificate of Condition either online or by mail.

ORDER A CERTIFICATE OF Proficient Standing

Asking a Certificate Online through the Florida Section of State

Download Course

Fee:$5 (Nonrefundable)

How to Deliquesce an LLC in Florida

If at any point in the future you no longer wish to conduct business concern with your LLC, information technology is important to officially dissolve it. Failure to practice then in a timely fashion can effect in taxation liabilities and penalties, or even legal trouble. To dissolve your LLC, there are 2 broad steps:

- Close your business revenue enhancement accounts

- File the Articles of Dissolution

When y'all are set to dissolve your LLC, follow the steps in our Florida LLC Dissolution Guide.

State of Florida Quick Links

Fundamental Terms for Entrepreneurs

LLC: An LLC is a US business organization structure that offers the personal liability protection of a corporation with the pass-through revenue enhancement of a sole proprietorship or partnership.

DBA: A DBA, or doing business concern every bit proper name, is any name a concern operates nether that isn't its legal name.

Partnership: A partnership is an breezy concern construction endemic by more than one individual that doesn't provide personal liability protection.

Source: https://howtostartanllc.com/florida-llc

Posted by: kinneygallembey.blogspot.com

0 Response to "How Do I Register A Business Name In Florida"

Post a Comment